Many investors are excited about the outlook for the electric vehicle industry. These battery-powered devices do not require gasoline or diesel fuel to operate and provide a better transportation solution to help combat air pollution. The adoption of EV is progressing, Tesla (TSLA 5.48%). Equities and sectors turned into an investment boom in 2021.

But now, by mid-2022, much of that enthusiasm has diminished, stock prices have fallen sharply from record highs, and could offer long-term investors a buying opportunity. Let’s see if it’s the right time to buy some EV stocks.

Image Source: Getty Images.

Ascending and descending

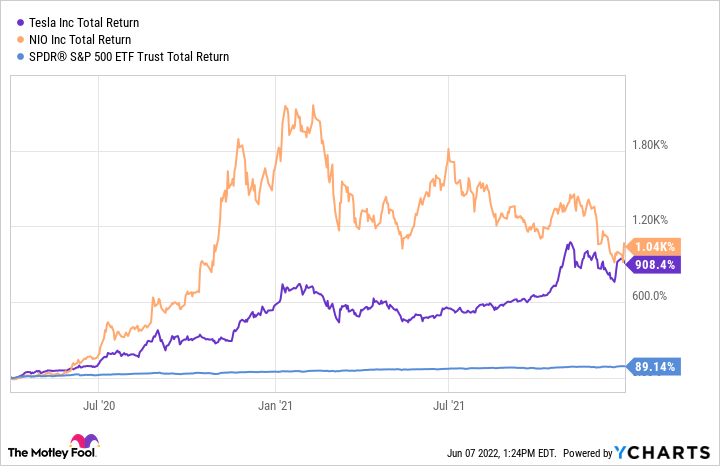

It’s unclear exactly why investors were so excited about EV stocks, but the excitement from the March 2020 market lows has overdriven.For example, with Tesla Nio (NIO 7.77%). From March 2020 to the end of 2021, it surged to over 1,000%, well above the 89% total return of the S & P 500 during that period.

TSLA total return level data by Y Charts.

Most of these profits were not due to the fundamental growth of these two businesses. Gross earnings per share during this period increased by approximately 100% in Tesla and 192% in Nio, most of which was due to multiple expansions and both stock price-to-sales ratios in early 2021 ( P / S) has reached 30. Typical car makers are trading at P / S close to 1. From late 2020 to 2021, many EV companies went public on many fanfares against the backdrop of this hype, promoting an early public offering (IPO) share pop that hasn’t been seen since Dot. -2000 com bubble. There is no better example. Rivian AutomotiveAn EV maker whose inventory was valued at over $ 100 billion when it wasn’t producing vehicles yet.

Now in 2022, EV inventories have dropped significantly. All major EV companies are starting the year behind the S & P 500, with inventories dropping by more than 30% in just a few months. The most badly valued Rivian in the group has lost 72% of its stake this year.

TSLA total return level data by Y Charts.

Secular tailwind is strong

There is no doubt that EV investors were right about the big opportunities in the industry. Automotive analysts expect global EV sales to reach $ 800 billion annually by 2030, making it one of the largest in the world. With over 60 million new cars sold worldwide each year and an average new car price of tens of thousands of dollars, it’s easy to see why so many companies are investing in EV space. The opportunities are enormous.

In addition, many governments around the world are encouraging companies to move to EV manufacturing, so the entire human race has decided to move. Gasoline cars have no chance and could become a small part of the market within a few decades.

So while stocks are down, long-term opportunities aren’t compromised, so you should buy stocks, right? Not so fast …

Why i’m still away

Even if a large number of EV stocks are falling from high prices, it does not necessarily mean that they will be purchased. There are two main reasons why I’m away from these companies as a potential investment.

First, the automotive business has proven to be extremely competitive and difficult to win over the last 100 years.Only two automakers have never gone bankrupt in the United States (with Tesla) Ford), This is due to the cyclicity and capital intensity of automobile manufacturing. At the beginning of the 20th century, after the first car revolution, dozens of car makers began to enter, but the majority failed due to how difficult it was to keep the business running downcycle. This is likely to happen with EV makers in the coming decades, and I’m worried about predicting who the few winners will be.

Data from TSLA prices to free cash flow by Y Charts.

Second, stocks are still well-valued compared to legacy car makers. For example, Tesla trades on over 100 Price-to-Free cash flows (P / FCF), while Ford only trades on 13.8 P / FCF. Tesla may grow faster than Ford, but it’s not like a legacy car maker sitting and watching the EV revolution pass by.

Ford has invested tens of billions of dollars in EV manufacturing over the last decade, with investments from other major manufacturers. Volkswagen When Toyota, This will significantly intensify the competition for personal consumption. This puts a risk on investors in pure EV stocks, especially EV stocks that are traded in multiples of high profits.

The EV revolution is definitely underway. But that doesn’t mean that stocks are guaranteed to be a good investment.